To acquire a car on loans is one of the most prominent ways to get behind the wheel of a separate model, but can your money a motor vehicle if you have poor credit? Read on for all you would like to know.

Luckily that you could become approved getting car loan even though you have a bad credit score. There’s no lowest credit score to track down accepted, you simply need to choose the best bank.

The choices can be minimal, and several loan providers will get raise interest rates for those having bad borrowing. This article commonly take you step-by-step through getting an educated handle a dismal credit score.

It is vital to remember to stand in your function in the event it comes to funding. Or even believe you really can afford new monthly installments, after that buying when you look at the cash is usually an option. When you are up against monetary dilemmas, you ought to consult an independent financial mentor.

How to improve your probability of are approved to own auto loan which have bad credit

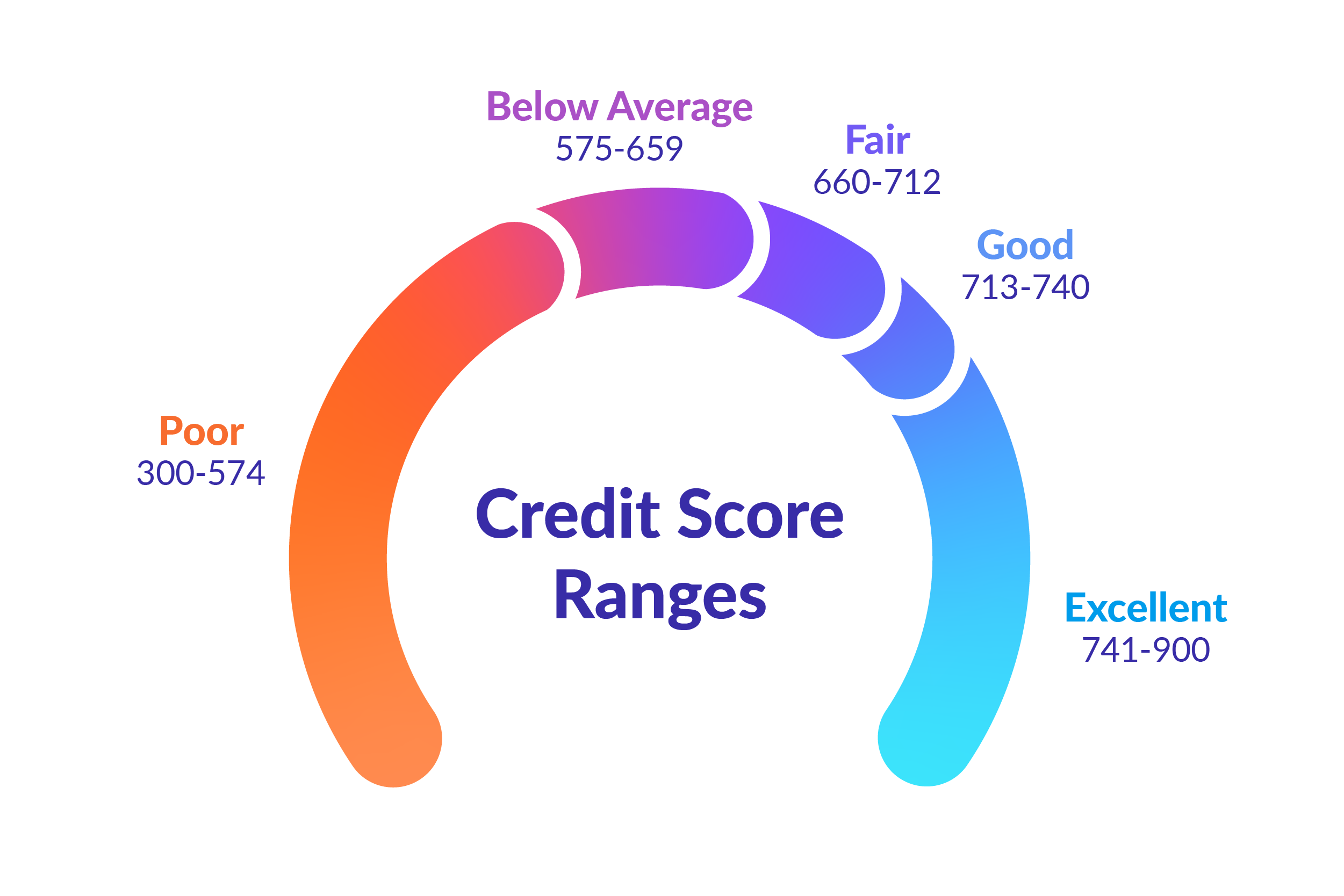

Your credit score is essentially debt background, and you may loan providers uses it to assess the risk of giving your credit (such as for instance an auto loan contract).

Your credit score might be influenced by things like missing financing repayments, a good expenses, being declared bankrupt and you may and make late costs into expense. You can examine your credit rating free of charge through of numerous borrowing from the bank referencing organizations.

For those who have a decreased credit rating, you will find things to do to improve it. Below are some pointers to possess improving your credit score:

Pay off the money you owe

The most obvious means to fix improve your credit score will be to repay one a good expense you have. It won’t rub your credit score brush, however, cleaning as much obligations as you’re able reveals lenders you to you are making positive strategies to switch they.

you must keep an eye on your expense. Losing trailing on the cellular phone contract and power bills can have a large influence on the score, so make certain that these are the up to date.

Keep loan applications to a minimum

When you make an application for financing, the lending company will do what is actually known as a great hard search’ you. This type of remain on your personal credit record.

It is advisable then to prevent obtaining unnecessary money. If you would like score a sense of whether you will feel recognized, most loan providers can get an eligibility examiner (also referred to as a silky lookup) that will not show up on your credit history.

Is actually a beneficial guarantor mortgage

Particular loans will come toward option to nominate a good guarantor (individuals who will result in paying down the loan if you skip your repayments). You will need individuals willing to sign the newest arrangement since the an excellent guarantor, no matter if.

Improve your deposit

It could be better to score a fund arrangement for folks who enhance your initially deposit. Very finance companies have a tendency to require a deposit of around 10% of vehicle’s worth, not, investing far more upfront reduces the risk toward bank and will improve your likelihood of bringing accepted.

Where you’ll get car loan which have less than perfect credit

This new trickiest section of providing car loan when you have crappy borrowing are trying to find a lender who’ll approve you. Simply because it view you once the a higher risk in order to lend to.

However, there are alternatives for those with less than perfect credit, you just need to choose which is right for you. Below are a few of the towns and cities you could look at bringing funded.

Through a dealership

Most fundamental traders gives money in a few means or some other, usually Individual Bargain Buy or Hire purchase. Buyers generally have lower criteria to have a financing arrangement as you are securing a loan against the car, for them to repossess it if you’re unable to maintain on the fund payments.

That it reduces the danger towards the bank, so it’s likely to be that you’ll be recognized. You need to be apprehensive about probably large rates on the supplier funds, and make certain you could potentially comfortably spend the money for monthly payments in advance of signing for the dotted line. Consider, paying for the money is always an alternative.

Courtesy a bank

A lot of finance companies offer car loan, together with interest levels may be lower than you’ll get regarding a dealership. The primary is to check around on the lowest prices, then make use of the company’s eligibility examiner to find out if you’re going to be acknowledged versus a full application.

A financial could be able to give your a personal mortgage to purchase your 2nd auto. This could be covered against a secured item for instance the vehicles or your home, thus be most careful whenever heading down this route and start to become yes you may make the repayments.

Precisely what do you need to submit an application for car finance?

To apply for financing, you may need evidence of ID (such a creating permit otherwise passport), evidence of target (like a computer program bill), and you will a deposit to get down initial. Particular lenders may also inquire about a number of payslips while the proof of money, particularly if you features the lowest credit rating.

How does car loan affect your credit score?

This will depend into the whether you maintain your repayments or maybe not. If you make all percentage promptly otherwise very early, this will help to change your credit score.

For those who get behind otherwise end to make your payments, just could possibly get your car be repossessed your credit rating will begin to drop. It’s ergo that you ought to very carefully consider carefully your month-to-month funds and simply borrow what you can manage to shell out straight back.

Looking for an easy way to alter your vehicle? After that head over to carwow. You could potentially promote your old car, and then have a lot towards an alternate one through our very own system from respected people, all from the settee. Faucet the fresh switch less than to begin with today.