VỀ CHÚNG TÔI

Đức Trung là đơn vị chuyên sâu trong lĩnh vực sản xuất – chế tác – thi công các sản phẩm đá mỹ nghệ và đá phong thuỷ cao cấp phục vụ cho công trình tâm linh, nhà ở, sân vườn và cảnh quan kiến trúc. Với nền tảng là văn hoá truyền thống kết hợp công nghệ hiện đại, chúng tôi mang đến những giá trị bền vững, mang đậm dấu ấn văn hoá và tâm linh người Việt.

Chúng tôi trực tiếp thiết kế – gia công – lắp đặt các hạng mục như: lăng mộ, cổng đá, trụ đá, tượng đá, linh vật phong thuỷ, đá tiểu cảnh, đá ốp lát sân vườn và các vật phẩm trang trí bằng đá tự nhiên. Đức Trung cam kết sử dụng nguồn đá chất lượng cao từ các vùng đá nổi tiếng như Yên Bái, Ninh Bình, Thanh Hóa,… đảm bảo độ bền, tính thẩm mỹ, và yếu tố phong thuỷ chuẩn mực.

Với phương châm “Tâm trong đá – Nghề truyền đời”, Đức Trung không chỉ là nơi gìn giữ tinh hoa nghề đá, mà còn là đối tác tin cậy đồng hành cùng khách hàng trong việc kiến tạo không gian sống và công trình linh thiêng đầy ý nghĩa.

SẢN PHẨM NỔI BẬT

Lan Can Đá Lầu Trà – Công Trình Đẳng Cấp Tại Đức Trung

Bàn thờ Thần Tài đá đẹp – Chuẩn phong thuỷ hút tài lộc

Biển đá Rượu Bình Minh đẹp nhất 2025 - Đá Đức Trung

Bộ bàn ghế đá ngọc Serpentin sân vườn cao cấp

Tác phẩm đá ngọc Serpentin Long Phụng Sum Vầy

Quan tài đá ngọc Serpentin nguyên khối chạm rồng đôi - song long hộ mộ

Cặp rùa hạc đá ngọc phong thủy đặt lăng mộ – đền chùa

Bức án thư - bàn lễ đá ngọc Serpentin cao cấp - Đá mỹ nghệ Đức Trung

Lắp đặt mái đao cổng tam quan truyền thống chuẩn kiến trúc tâm linh Việt – Đức Trung

Biệt Thự Ốp Đá Ngọc Serpentin – Sang Trọng, Phong Thủy & Đẳng Cấp Trường Tồn

Cột đồng trụ vuông đá ngọc Serpentin nguyên khối cao cấp

Biển Công ty Đá mỹ nghệ - Đá phong thuỷ Đức Trung

Đồng hồ đá ngọc Serpentin – Chim đậu cành hoa

Tranh Tùng Hạc Diên Niên đá ngọc Serpentin nguyên khối chạm khắc tinh xảo

Tượng Rồng Nam Mỹ đá ngọc Serpentin

Tượng truyền thần phù điêu trên đá ngọc Serpentin

Mộ đôi đá ngọc Serpentin nguyên khối cao cấp tại Công viên Thiên Đức

Bức án thư đá ngọc Serpentin mẫu hiện đại tại Công viên Thiên Đức

ĐÁ CÔNG TRÌNH TÂM LINH

Bàn thờ Thần Tài đá đẹp – Chuẩn phong thuỷ hút tài lộc

Quan tài đá ngọc Serpentin nguyên khối chạm rồng đôi - song long hộ mộ

Cặp rùa hạc đá ngọc phong thủy đặt lăng mộ – đền chùa

Bức án thư - bàn lễ đá ngọc Serpentin cao cấp - Đá mỹ nghệ Đức Trung

Lắp đặt mái đao cổng tam quan truyền thống chuẩn kiến trúc tâm linh Việt – Đức Trung

Cột đồng trụ vuông đá ngọc Serpentin nguyên khối cao cấp

Mộ đôi đá ngọc Serpentin nguyên khối cao cấp tại Công viên Thiên Đức

Bức án thư đá ngọc Serpentin mẫu hiện đại tại Công viên Thiên Đức

Cổng tam quan trụ biểu đá ngọc Serpentin nguyên khối cao cấp chạm khắc tinh xảo

Lăng thờ - Long đình đá ngọc đẹp tinh xảo – Đá Đức Trung

Bức cuốn thư, bình phong đá chạm khắc tinh xảo – Đức Trung

Cổng tam quan truyền thống chuẩn kiến trúc tâm linh Việt – Đức Trung

ĐÁ MỸ NGHỆ CAO CẤP

Đồng hồ đá ngọc Serpentin – Chim đậu cành hoa

Tranh Tùng Hạc Diên Niên đá ngọc Serpentin nguyên khối chạm khắc tinh xảo

Tượng Rồng Nam Mỹ đá ngọc Serpentin

Tượng truyền thần phù điêu trên đá ngọc Serpentin

Tượng Quan Công đá ngọc Serpentin nguyên khối chạm khắc tinh xảo

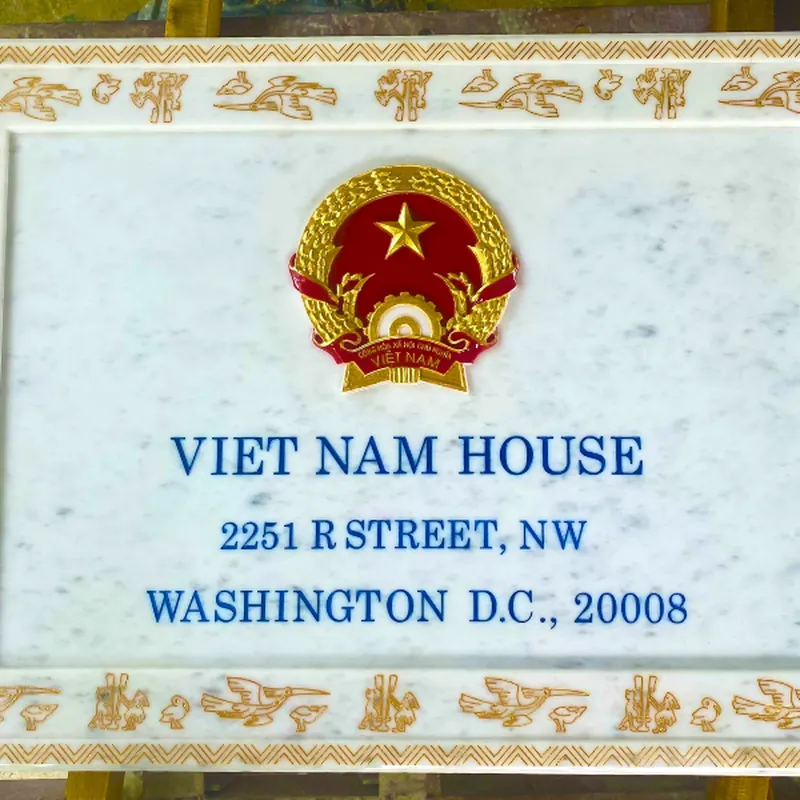

Biển Trụ sở cơ quan ngoại giao Việt Nam tại Hoa Kỳ - VIET NAM HOUSE

LINH VẬT & VẬT PHẨM PHONG THUỶ

Bàn thờ Thần Tài đá đẹp – Chuẩn phong thuỷ hút tài lộc

Tác phẩm đá ngọc Serpentin Long Phụng Sum Vầy

Cặp rùa hạc đá ngọc phong thủy đặt lăng mộ – đền chùa

ĐÁ MỸ NGHỆ XÂY DỰNG

Lan Can Đá Lầu Trà – Công Trình Đẳng Cấp Tại Đức Trung

Biệt Thự Ốp Đá Ngọc Serpentin – Sang Trọng, Phong Thủy & Đẳng Cấp Trường Tồn

Công trình nhà ở đá ngọc Serpentin - mẫu cao cấp, hiện đại

Trụ lan can đá Marble vàng Ai cập

Thi công, xây lắp công trình nhà ở đá cao cấp

Phù điêu đỉnh mái vòm cửa đẹp tinh xảo - Đá Đức Trung

ĐÁ TIỂU CẢNH - SÂN VƯỜN

Lan Can Đá Lầu Trà – Công Trình Đẳng Cấp Tại Đức Trung

Biển đá Rượu Bình Minh đẹp nhất 2025 - Đá Đức Trung

Bộ bàn ghế đá ngọc Serpentin sân vườn cao cấp

Tác phẩm tiểu cảnh đá ngọc Serpentin – chùa đình – sơn thuỷ hữu tình

Biển Công ty Đá mỹ nghệ - Đá phong thuỷ Đức Trung

Biển Trụ sở cơ quan ngoại giao Việt Nam tại Hoa Kỳ - VIET NAM HOUSE

MỚI NHẤT

Cột đá đồng trụ tròn trạm khắc hoa văn tinh xảo - Đá Đức Trung

Cổng tam quan truyền thống chuẩn kiến trúc tâm linh Việt – Đức Trung

Thi công, xây lắp công trình nhà ở đá cao cấp

Phù điêu đỉnh mái vòm cửa đẹp tinh xảo - Đá Đức Trung

Trụ lan can đá Marble vàng Ai cập

Bức cuốn thư, bình phong đá chạm khắc tinh xảo – Đức Trung

XEM NHIỀU NHẤT

Cổng tam quan truyền thống chuẩn kiến trúc tâm linh Việt – Đức Trung

Cột đá đồng trụ tròn trạm khắc hoa văn tinh xảo - Đá Đức Trung

Bức cuốn thư, bình phong đá chạm khắc tinh xảo – Đức Trung

Thi công, xây lắp công trình nhà ở đá cao cấp

Trụ lan can đá Marble vàng Ai cập

Phù điêu đỉnh mái vòm cửa đẹp tinh xảo - Đá Đức Trung

BÁN CHẠY

Bộ bàn ghế đá ngọc Serpentin sân vườn cao cấp

Cặp rùa hạc đá ngọc phong thủy đặt lăng mộ – đền chùa

Lắp đặt mái đao cổng tam quan truyền thống chuẩn kiến trúc tâm linh Việt – Đức Trung

Tượng truyền thần phù điêu trên đá ngọc Serpentin

Mộ đôi đá ngọc Serpentin nguyên khối cao cấp tại Công viên Thiên Đức

Bức án thư đá ngọc Serpentin mẫu hiện đại tại Công viên Thiên Đức

BÀI VIẾT HAY

12/09/2025 | 601 Lượt xem

Giải mã quan niệm kiêng tu sửa, cải táng phần mộ vào năm nhuận âm lịch. Thực hư ra sao, có nên lo ngại hay vẫn có thể tiến hành bình thường?

24/08/2025 | 674 Lượt xem

Xây dựng lăng mộ tổ tiên không chỉ là việc tri ân cội nguồn mà còn ảnh hưởng trực tiếp đến vận khí, tài lộc của con cháu. Bài viết chia sẻ chi tiết những điều nên làm và kiêng kỵ trong phong thuỷ khi xây dựng lăng mộ dòng tộc, giúp gia tộc hưng thịnh, phúc ấm bền lâu.

17/08/2025 | 643 Lượt xem

Quan tài đá ngọc Serpentin – sản phẩm đá mỹ nghệ cao cấp, chế tác độc bản theo đơn đặt hàng, mang giá trị tâm linh và khẳng định vị thế gia chủ.

09/08/2025 | 623 Lượt xem

Khám phá cuốn thư đá ngọc serpentin – biểu tượng hộ pháp trong kiến trúc tâm linh Việt. Phân tích ý nghĩa phong thuỷ, sự kết hợp với cổng tam quan, lăng mộ, linh vật để bảo vệ và gìn giữ linh khí dòng tộc.

04/08/2025 | 1362 Lượt xem

Tìm hiểu nên làm lăng mộ vào mùa nào là tốt nhất theo phong thuỷ và kinh nghiệm dân gian. Gợi ý thời điểm đẹp, các mùa cần tránh và lưu ý quan trọng khi xây mộ.

29/06/2023 | 918 Lượt xem

Bài viết là hành trình khám phá nghề đá truyền thống qua góc nhìn của người thợ: từ mồ hôi lao động đến nghệ thuật tâm linh. Mỗi công trình không chỉ là sản phẩm kỹ thuật, mà là kết tinh của văn hóa, cảm xúc và niềm tin được tạc vào từng phiến đá.